Last Updated on 5 years by Naveen Kumar

Though we are half way past 2019 and it might seem like its quite late to publish this report, we couldn’t resist to ignore these eye opener facts and findings. Moreover, we have tried our best to ensure that the data was collected from the most reliable sources on the internet.

Here is the biggest report from us this year on Indian Fashion Industry Analysis.

About the Indian Fashion Industry Analysis Report

This report intends to provide a summarized overview and some key insights of the fashion industry in India, like the spending pattern of customers, their buying preferences, primary drivers of growth in fashion, total apparel sales and also the future of fashion in India.

Primary sources from which the information contained in this report, are clearly cited at the end of the article as well on the PDF available for download. We’ve taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, a word of caution, since the data has been collated from multiple sources, Fashion Suggest is in no way responsible for any errors or omissions in analysis/inferences/views of this report.

Overview of Indian Fashion Industry

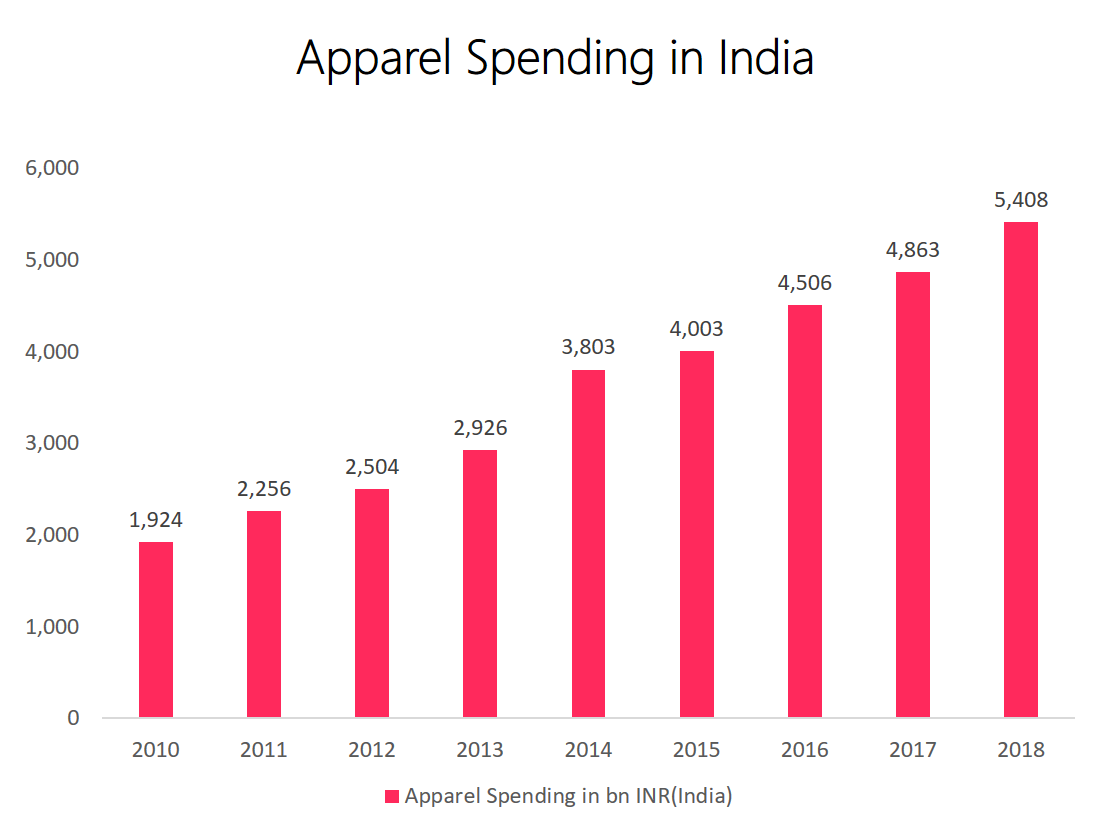

In 2018, Indians spent INR5408 billion on clothing, while in 2010, it was only INR1924 billion, thus clearly indicating a tremendous growth, that can be attributed to following factors:

- Higher disposable income – With better education, higher employment rates and larger income scale, people today have more purchasing power than before.

- Infrastructure – With cities and towns growing bigger and larger, the infrastructure in the country has also been witnessing better growth.

- Opening of brands in non-metro cities – Most fashion brands are tapping into semi urban pockets as well, to widen their customer base.

Apparel sales in India

The total apparel sales in India has significantly elevated over the past few years due to people having higher exposure to retail stores and smart devices. Tier 1 cities like Delhi etc top the list of major spenders.

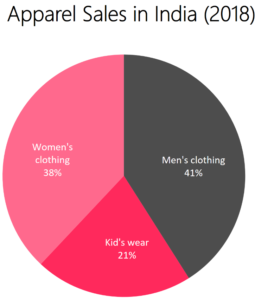

Here is a breakdown of the total apparel sales in India in 2018

- Men segment (41%)

- Found to be the major segment of the Indian apparel market.

- Shirts and trousers form the major sub segments.

- Denim and fitness wear are the fastest growing sub-segment

- Women segment (38%)

- Traditional/ethnic wear is the major sub-segment.

- The robust growth in this segment is mainly attributed to the rising income levels, increase in the number of working women and more college going females.

- Craving for Western styles are also steadily increasing.

- Kids segment (21%)

- Forms the smallest yet the fastest growing segment

- School uniforms form the largest sub-segment

Purchasing behaviour of consumers in India

Talking more about spending and purchasing, lets have a look at who is buying what? Who forms largest consumers of fashion and apparel in India?

Youth within age group of 18- 25 years shop more.

Women tend to be more selective and prefers online shopping, esp niche sites & social media, than brick & mortar stores.

Medium priced apparel holds the predominant share followed by economy range, reflecting on the consumers value-conscious mentality.

Researches have also found the below are shaping the shopping behaviour of people in India.

- Personalisation – Customers, today, are not expecting huge collections in stores but they want to see the most appropriate selection for them, in terms of personal preferences. Brands have quite evidently focused on personalization to showcase to customers the most relevant items.

- Artificial Intelligence – AI is shaping the way people shop; they are improving customer experience, in terms of providing automatic recommendations, different ways of performing search, ways of engaging with our ecosystem, and for the brands, optimising the cost of handling all customer queries.

- Craving for newness – Young people today crave new styles, and these cohorts are much more likely to embrace a visible churn in their wardrobes.

- Discounts – Even consumers with six-figure incomes are looking for offers, discounts and alternative models of value acquisition. Luxury brands are significantly increasing the prices, Prices of premium watches and fine jewellery have multiplied since 2005, according to Coutts.

What are the barriers for fashion industry growth in India?

- Income gap and corruption – According to Transparency International, India ranks 81st in terms of Corruption Perception Index. This reflects a high level of disparity in income levels. The gap between the top one percent of earners and the middle class is at its peak, in 92 years.

- Poor infrastructure – Nearly 40 percent of the Indian road network was unpaved as of 2016. Lack of proper infrastructure has been key in making last mile delivery gruesome.

- Licences – A significant number of licenses are required for new entrants, so executives should beware of the potential for complicated negotiations. Stringent government regulations are also another barrier to growth of fashion.

So, what is the future of fashion industry in India?

Despite the primary challenges like inequality, infrastructure and market fragmentation, there is a strong expected growth in the economy and a rise in the levels of tech-savviness. These coupled together can make India the next big global opportunity in fashion and apparel industry.

In short, the Indian market holds great promise.

Here are the findings in detail

- By 2022, 690mn people are expected to be online on smart devices, attributing to elevated exposure to e-commerce portals.

- 300+ international fashion brands are expected to open stores in India in the next two years. Zara and H&M have already crossed a turnover of INR 1,000 crores in India.

- Craving for Western styles are likely to increase, though traditional wear is still expected to account for 65 percent of the market share by 2023

- Significant growth in luxury spending in Delhi, Mumbai and Bangalore. Kolkata, Chennai, Pune and Hyderabad have emerged as new centres of luxury consumption

What according to you should India’s fashion industry focus on in the coming years?

What change would you like to see from the top brands?

Leave your thoughts in the comment below!

References:

- https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion-2019-a-year-of-awakening

- https://view.joomag.com/apparel-april-2019/M0202220001557298887

- http://www.technopak.com/Files/indian-apparel-market.pdf

Banner image courtesy : Ajay Pandey

Well Researched and diagnosed post. I am impressed with the post. Thanks for sharing such a great article.

Glad that you liked it Naysha. Feel free to share it on social platforms too.

I’m extremely impressed with your writing skills as well as with the layout on your weblog.

Is this a paid theme or did you modify it yourself?

Anyway keep up the nice quality writing, it’s rare to see a great blog like this one nowadays.

Nice work

great work. thank you so much!